Tax Deducted at Source (TDS) on rent is an essential aspect of Indian tax laws, especially for Non-Resident Indians (NRIs) who own property in India. Understanding the TDS rules on rental income can help NRIs maximize their benefits and avoid any legal hassles. This blog provides a comprehensive guide on TDS on rent for NRIs, highlighting the rules, compliance requirements, and how NRIs can make the most of these regulations.

Understanding TDS on Rent for NRIs

TDS on rent refers to the amount deducted by the tenant before paying the rent to the NRI landlord. This deduction is required by the Income Tax Act, 1961, to ensure that the tax liabilities of NRIs are met. Here’s a closer look at the rules governing TDS on rent for NRIs:

Key Rules of TDS on Rent for NRIs

- TDS Rate: For NRIs, the TDS on rent is deducted at 30% (plus surcharge and cess, if applicable) of the rental income. This rate is higher than the TDS rate applicable to resident Indians, making it crucial for NRIs to be aware of these implications.

- Mandatory Deduction: It is mandatory for the tenant to deduct TDS before making the rental payment to the NRI landlord, irrespective of the amount of rent. Failure to do so can lead to penalties for the tenant.

- Form 15CA and 15CB Compliance: Before remitting the rent amount to the NRI, the tenant must file Form 15CA, which is a declaration of the remittance to the Income Tax Department. In certain cases, Form 15CB, certified by a Chartered Accountant, is also required to ensure that taxes are correctly deducted and remitted. For more information, you can refer to the Income Tax Department’s guidelines on Form 15CA and 15CB.

- No Basic Exemption: Unlike Indian residents, NRIs are not entitled to the basic exemption limit on TDS for rental income. Therefore, the deduction applies from the very first rupee earned as rent.

- PAN Requirement: Both the NRI landlord and the tenant must have a valid Permanent Account Number (PAN) in India. If the NRI landlord does not provide a PAN, TDS can be deducted at a higher rate. Check the official PAN guidelines here.

- Double Taxation Avoidance Agreement (DTAA): India has DTAA treaties with several countries, which can help NRIs avoid paying taxes twice on the same income. NRIs can avail benefits under DTAA, which may allow them to pay taxes at a reduced rate or claim a tax credit in their country of residence. For details on DTAA, refer to the DTAA page on the Income Tax Department’s website.

How NRIs Can Make the Most of TDS on Rent

- Lower TDS Rate via DTAA: If the NRI’s country of residence has a DTAA with India, they can avail a lower TDS rate by submitting the necessary tax residency certificate and other documents. This can significantly reduce the tax burden on rental income.

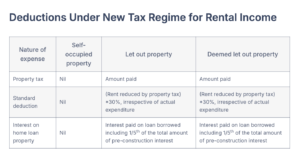

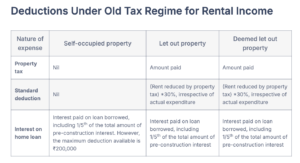

- File Income Tax Returns in India: Filing income tax returns in India allows NRIs to claim deductions and exemptions, such as under Section 24 for home loan interest or standard deductions on rental income. Filing returns can also enable NRIs to claim a refund if excess TDS has been deducted. Visit the Income Tax e-Filing Portal for more information.

- Claim Deductions: NRIs can claim deductions on expenses related to the property, such as municipal taxes, maintenance charges, and repairs. These deductions can help reduce the overall taxable rental income, lowering the TDS impact.

- Obtain a Lower TDS Certificate: NRIs can apply for a lower TDS certificate from the Income Tax Department if they expect their total income to be taxed at a lower rate. This certificate allows tenants to deduct TDS at a rate lower than the standard 30%. For guidelines on applying for a lower TDS certificate, check the official TDS guidelines.

- Use of PAN to Avoid Higher Deductions: Ensure that the NRI landlord’s PAN is correctly furnished to the tenant. Not providing a PAN can lead to a TDS deduction at a much higher rate, impacting the NRI’s net rental income.

- Utilize Property Management Services: Hiring a property management service can streamline the process of tax compliance, rent collection, and maintenance for NRIs. These services often include assistance with TDS and other tax formalities, helping NRIs manage their investments efficiently.

Common Mistakes to Avoid

- Non-Compliance with TDS Rules: Tenants failing to deduct TDS or NRIs neglecting to comply with Indian tax laws can result in penalties and interest charges. Ensuring compliance with TDS rules is crucial to avoid legal complications.

- Ignoring DTAA Benefits: Many NRIs miss out on DTAA benefits simply because they are unaware of the treaties. Consulting with a tax expert can help NRIs understand and claim DTAA benefits effectively.

- Not Filing Tax Returns: Even if TDS has been deducted at the source, filing income tax returns in India is essential for NRIs to claim deductions and refunds. It also establishes a record of compliance with Indian tax laws.

Conclusion

Navigating the TDS on rent for NRIs in India requires a thorough understanding of the rules and strategic planning to maximize benefits. By staying compliant, leveraging DTAA provisions, and seeking professional tax advice, NRIs can efficiently manage their rental income and minimize tax liabilities. Whether you are an NRI property owner or a tenant renting from an NRI, being well-versed with these guidelines can help you avoid pitfalls and make the most of the opportunities within the Indian tax system.