SECOND QUARTER HOUSING TRENDS 2021

The booming real estate discovered a new trend last year, COVID special. The pandemic has lasted more than we thought, during this period we realized Work from Home is here to stay for a longer period of time, The pandemic has changed our perspective about how we live, where we work, how both the thing can be under one roof.

Real estate is much more than just a building and bricks now, the sector has always been on a roller coaster ride, last year the focus was on affordable housing, and lower interest rates made it all cheaper for the consumer. With offices shutting down and people working from home changed the whole demand for residential and commercial properties in 2020. In 2021 as things are falling into places again but still the impact of last year is going to stay around.

Prior to lockdown, the gap between income and EMI was huge because income and interest rates along with the pricing of the properties were in rising demand, but in recent years the ratio has come down from 50 to 25% which is a good indication.

Adapting New Normal: Housing Trends 2021

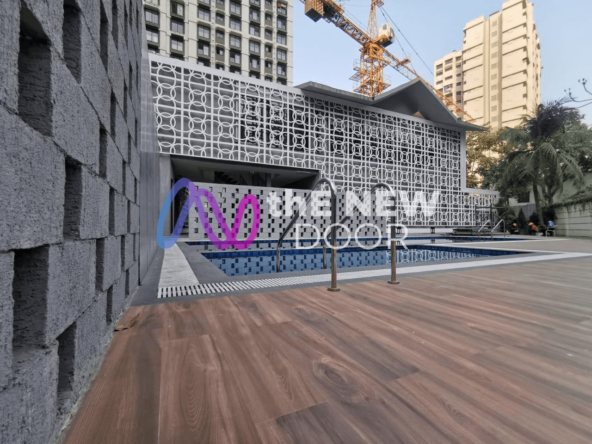

This “New Normal” is impacting housing preferences for people, the new pandemic has resulted in a fitness trend, now customers want a house which provides them a healthy lifestyle with all amenities like gym, Yoga center, Pool, Kids area, green open places, etc.

Meanwhile, senior citizens living alone were most impacted during the pandemic. The role of organized senior living facilities such as medical support on call, services for food, housekeeping, and assistance around the clock became more important nowadays. This has increased the attractiveness of such facilities and demand for organized senior housing setups is expected to rise in the near future.

Changing Preferences:

The new normal is also bursting the myth about having a property in city areas. Most of the population in metro cities are returning towards the suburbs, since remote working is trending, buying a house of their choice has become easier than ever before. This has impacted a high demand for apartments in semi-urban and nearby city areas, since traveling to work is not a daily activity anymore. Meanwhile, as per the new union budget the government is boosting affordable housing which resulted in home loan rate deduction for first-time buyers, the age group of up to 40 years is now more interested in buying a property than in other investments.

Let’s work together:

When it comes to commercial spaces, employers are preferring *co-working* places now. As it is a popular alternative to working from home. Co-working spaces are an emerging trend in India, finding a co-working place nearby your house is easy as well as pocket-friendly.

The rise in demand for emerging micro-markets:

Micro markets in different cities are witnessing huge demand for residential and commercial properties. Investors are more likely to invest in these markets as it’s cheap and the ROI in a few years is going to be huge. Research shows that these markets will drive high risk and high return policy in emerging economies. This is going to boost GDP as the real estate sector has a massive impact on boosting an economy.

Developer’s point of view:

Since lockdown there has been a steady demand for properties, with 2% Stamp duty registration charges in Maharashtra, there were a fair amount of properties sold in Mumbai and other parts of the state by NRI’s, Locals & outstation clients, but as we are back to 5% of SDR now it’s time to see how it is going to impact the developers and a consumer. Over the years, the construction cost was inflating, so affordable supply was slowly fading away even developers had to liquidate their assets to keep the business running. Overall it was a sloppy ride for developers, but the pandemic gave them little breather in terms of sales.

To conclude, we would suggest, it is a wise decision to invest in this sector as experts are optimistic about the future of the real estate industry in India. MNCs are driving the workforce into major cities, as it is going to create a high demand for residential property, of course not all can buy a flat the moment they tap into the new city, thus renting a place is going to be highly demanded in near future. The new world of *Co-living* and *co-working* places are on the way and we better jump into it and make the most out of it.